You’ve decided to start your own RIA….

Congratulations!

Or, maybe you’re still trying to figure out if you should start your own RIA or join an existing one. The decision can often seem overwhelming, especially when it comes to figuring out what the process is going to cost.

I can help with that.

In this article, I break down the process of creating a new RIA budget into steps.

Step 1: Determine your overall budget number.

I know that this first step might seem a bit counter intuitive. How can you possibly pick a number when you have no idea how much things are going to cost?

The truth is, your overall budget should have nothing to do with your actual expenses. The budget is just what you have available to spend or what you’re actually willing to spend. This number may end up looking VERY different than your total actual expenses.

The overall up-front budget is more of a guideline. A way for you to figure out whether or not you will need:

- Additional funding; or

- To consider joining an existing RIA to mitigate costs.

To calculate that total budget number, review your finances and figure out what your cash situation looks like. Record the portion of your own money you’re willing to spend.

Step 2: List your potential expenses.

This is where you get to do what I like to call a “brain dump”. Sit down and write or type out a running list of everything you can possibly think that you might need to spend money on to start your own RIA.

List it all. Even the things that might seem insignificant. You might think the cost of paperclips isn’t important, but when you combine that with the cost of all the other office supplies and equipment you need, it could add up very quickly.

Consider this a working list. More items will undoubtedly need to be added as you work your way through the due diligence process. As you develop your tech stack, you’ll have a better understanding of all the moving parts. Ideally, you might even be able to remove some of the original items from the list.

Step 3: Prioritize your potential expenses.

Organize your expenses into categories based on how they relate to one another. List them in order of priority. You can assign tags to them like:

- Essential

- Nice-to-Have

- Non-Essential

Once you’ve prioritized your expenses, you can better determine where your money will best be spent. No sense in shelling out dough on products and services, only to realize you’ve reached your proposed budget number much quicker than expected.

Step 4: Allocate your funds.

Start allocating your funds to your listed expenses. Start with the essentials, then the nice-to-haves, and address the non-essentials only once you’ve satisfied all the other requirements. Assign dollar amounts to each of the line items.

Step 5: Adjust your budget.

Now that you can see where your money should be spent, you can adjust your budget accordingly. Re-prioritize.

As you go through the research process, your priorities will change. Something you initially considered essential might actually turn out to be non-essential. Or vice versa.

Step 6: Track your actuals.

Once you start spending the actual dollars, or at least understand exact costs, you can compare your actual spending to your proposed spending.

The easiest way to keep track of what you’re actually spending versus what you originally proposed to spend, is to create an Excel spreadsheet showing 2 different columns.

The spreadsheet will come in handy if you know you need additional funding. You’ll see what your budget is based on what you can spend, versus what you actually need to spend, and what that difference is – your loan needs.

Let’s make the process as painless as possible.

The concepts are fairly self-explanatory, but the process is still time-consuming. Everyone’s situation is different.

Since I consult with my clients on the many aspects of starting an RIA, I’ve developed some helpful tools over time.

One of those tools is a spreadsheet that serves as a startup RIA cost calculator. I provide it to my consulting clients and now I want to offer it to you as well.

As an entrepreneur, a solopreneur at that, I understand what it’s like to start a business and have to wade through all the resources and research available in the market. I’m a do-it-yourselfer at heart and if there’s a way I can make your entrepreneurial journey a little bit easier, I want to do that.

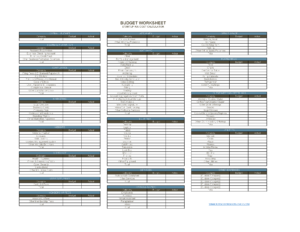

What’s included in the Budget Worksheet – Startup RIA Cost Calculator:

- 100+ Individual Expenses (line items)

- 11 Expense Categories

- 2 Value Columns:

- Proposed Spending

- Actual Spending

- Category Totals Using Formulas

- Overall Total (Totals of each category summed using formulas)

- Built-In Formulas for Adding Additional Line Items

- Built-In Formulas for Adding Additional Expenses that Don’t Fit into Existing Categories

- Easy One-Page Print Formatting

Essentially, I data dumped any and all expenses I could possibly think of (based on years of industry experience and process research) into a list and transformed that list into this Excel spreadsheet. I added helpful formulas, made it visually pleasing, and formatted it to print on a single page

It looks kinda like this…

Essentially, I did the bulk of the work for you.

You can purchase the spreadsheet here.

$27.00

Save yourself time and gain access to a tool you can start using immediately.

Best of luck in your new venture!

Subscribe to my mailing list to receive notifications when I make additional helpful resources available.