I have a confession to make…

I’m a transition consultant to financial advisors. I’ve been in the industry for 14 years – half of those in the RIA space. I’ve helped dozens of individuals and teams transition their books of business from one platform to another.

And until recently… I had no idea what the heck a TAMP was.

I knew it was an acronym that stood for Turnkey Asset Management Platform (or Program), but those words didn’t mean anything to me.

Apparently, I’m not the only one. “What is a TAMP” is a commonly Googled term, and there are several articles written that address the question. Unfortunately, those articles are written by individuals employed by TAMPs, so they serve more as advertisements than education.

So, how did I finally figure out what a TAMP is? Let me tell you the story of my quest for information.

Once upon a time (about 4 years ago), I started my own firm, and I was riding the roller coaster of entrepreneur emotions. Going from feeling like I was on top of the world, being free and empowered. Then, plunging back down with my stomach in my throat feeling terrified and like a total fraud.

I was speaking with an advisor who mentioned the word TAMP in passing and a fresh wave of imposter syndrome feeling washed over me. You know, when you have no idea what someone is talking about, but they seem to think you should, and you’re just hoping they’ll change the subject so you don’t have to pretend to know what you’re talking about when you clearly don’t. It was one of those moments.

That sick feeling was enough for me to immediately “give it a Goog”, as I like to say. Unfortunately, the definitions I read did not give me a full understanding of the term. As someone who has never been an advisor and will never need to use a TAMP, I settled for a vague understanding of the overall concept and hoped I wouldn’t have to speak much on the topic.

After a few more close calls, I decided to reach out to some business development reps at a few TAMPs. I asked them to explain the concept of a TAMP to me and the results were underwhelming. I got sales pitches and demos.

Don’t get me wrong, I love doing demos. I just don’t love doing demos of products or services that I don’t understand. It might be impressive technology, but there’s no guaranteeing I will recognize when I have an ideal prospect.

Enter GeoWealth.

TJ Gardner, a business development rep for GeoWealth, reached out to me on LinkedIn a while back and asked to connect. In his initial message, he explained that GeoWealth was a “tech and TAMP platform that works with advisors in transition/breakaways”. Already, he was speaking my language. So, I confessed that the concept of a TAMP confused me and asked him to explain it to me as if I were five.

His response: “A TAMP is a platform where an advisor can easily access suitability, investment management, and trading tools.”

Simple, concise, and easy to understand.

When I asked why the definition of a TAMP was so confusing, he explained that not all TAMPs are created equal, and the reason they are hard to define is that they all have different offerings, focuses, and capabilities. You can’t just say a TAMP is a technology and trading platform, because that could be misleading or inaccurate. Instead, you must use more general terms to describe it. Thus, the confusion and mystery surrounding the term.

He took the time to explain exactly what GeoWealth does and how it differs from other offerings. He was able to help me fully understand how a TAMP can function and how GeoWealth does function.

Now, I feel like I understand what a TAMP is and how to recognize an advisor who could benefit from the use of one. I can hold my own in a conversation and participate in a demo without feeling totally lost. I even know what questions to ask to understand a TAMP’s differentiators.

I discuss GeoWealth’s differentiators in this article. Not only as a way to educate but as a thank you to GeoWealth for educating me.

Let’s start with the basics.

GeoWealth was established in 2010 and is headquartered in Chicago. They have 70+ employees and have over $16 billion of assets on their platform.

Their offerings consist of a technology platform, a diversified lineup of model portfolios, the ability to implement advisor-managed models, flexible risk profiling, portfolio management tools, reconciliation, performance reporting, and billing.

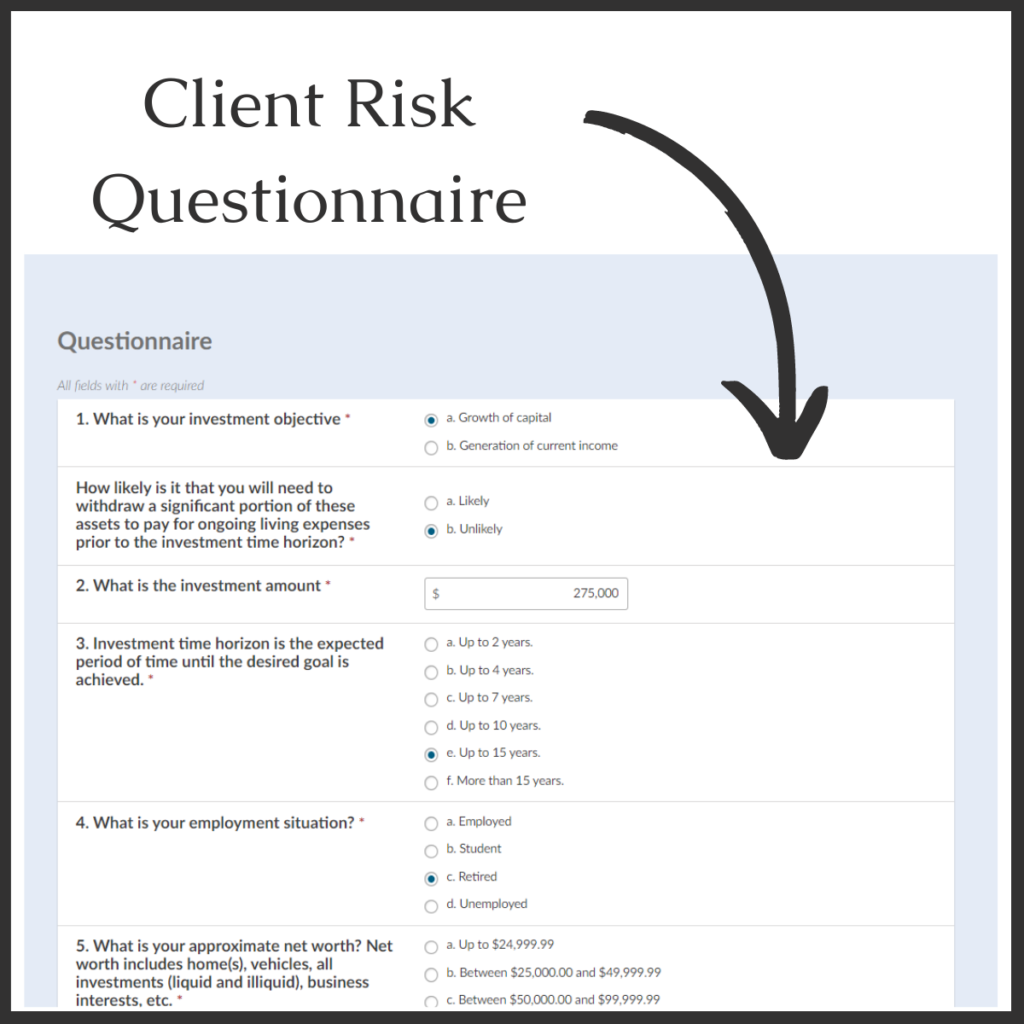

I even have some fancy screenshots of their technology to show you. Like this Client Risk Questionnaire.

And the risk profile scoring chart that gets generated as a result of the Client Risk Questionnaire being completed.

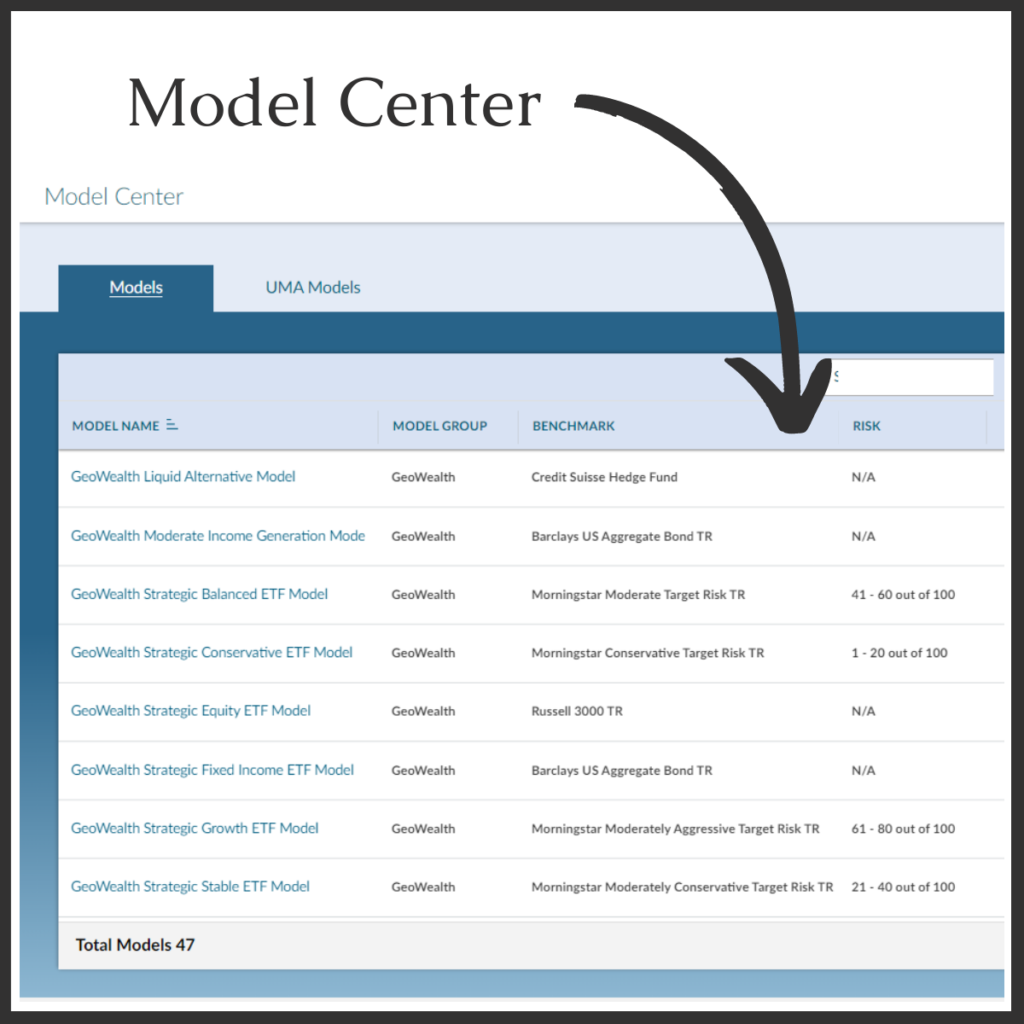

As far as technology goes, GeoWealth is a comprehensive, full-service TAMP. The platform is nimble and efficient, and they support the use of advisor-managed models as well as third-party models from top-tier asset managers such as JP Morgan, State Street Global Advisors, PIMCO, Fidelity, and more. Advisors can use a combination of the model types with ease, regardless of custodian, allowing for a consistent and flexible process. They even have the ability to support Unified Managed Accounts (UMAs) that combine multiple models within a singular account, which makes reporting much more seamless.

The combination of advisor-managed and UMA capabilities enables an advisor to outsource certain aspects of the investment management process, while keeping their fingerprints on the solutions they offer. In other words: win-win.

Just check out this screenshot of their Model Center.

GeoWealth has built their own proprietary technology and work with their own asset management team to save on costs and provide a smooth, reactive experience for their clients. One of their biggest draws is that they can keep their expenses lower by not licensing underlying technologies that traditionally pass expenses on to the advisor.

Each advisor is assigned a dedicated Relationship Manager who helps facilitate the initial transition onto the platform and continuously supports the advisor to ensure the platform is serving the best interests of the advisor and their clients. The Relationship Manager continues to serve as a resource throughout the advisor’s entire lifecycle and offers suggestions on how to best access and leverage new features as they roll out.

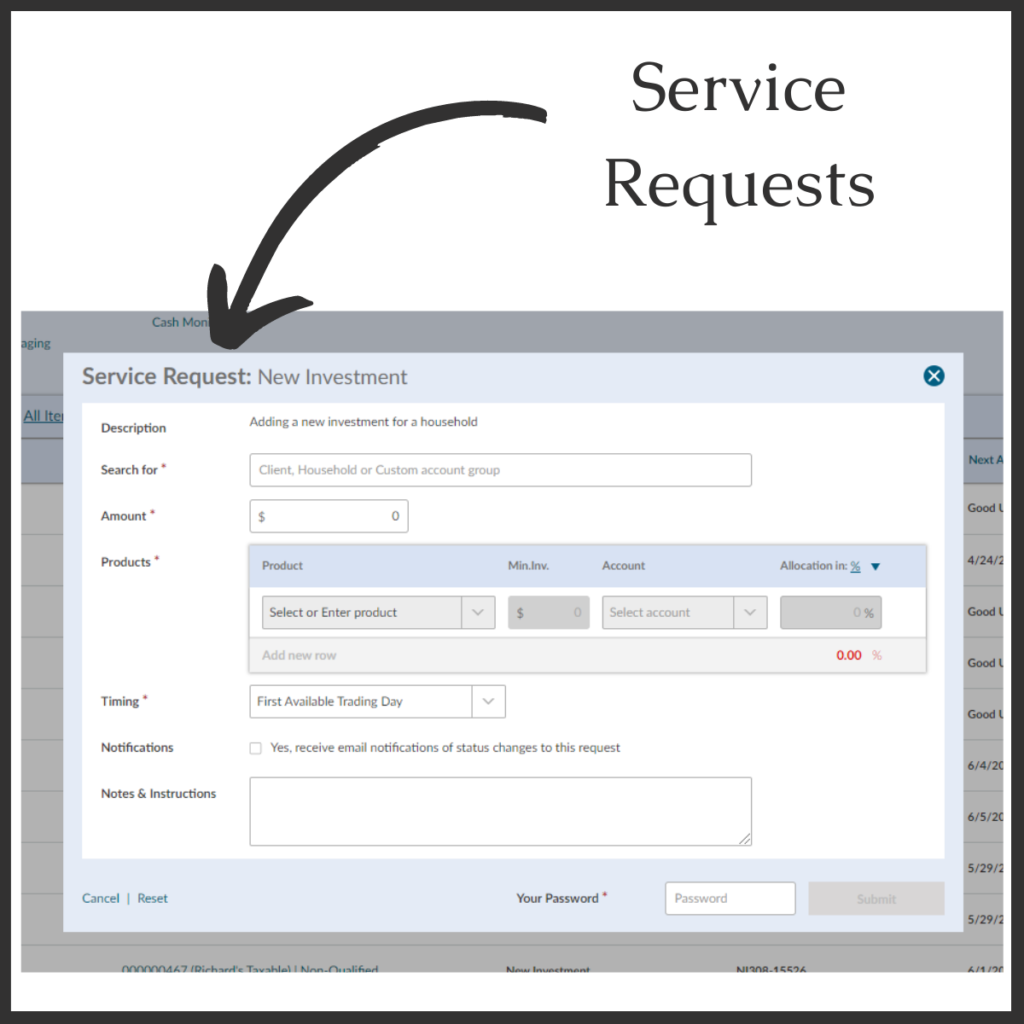

As I mentioned, I am not an advisor. However, I have worked for/with them my entire career in multiple capacities. My wheelhouse has always been operations, which is why my favorite part of the GeoWealth platform is their Service Requests. A simple, straight-forward way to make requests.

To me, one of the most important things about adopting new technology is making sure it’s easy to use and benefits the whole team. It’s crucial to consider who will be using it and for what purposes it will be used. Catering to advisors is very different than catering to their support staff. GeoWealth does both.

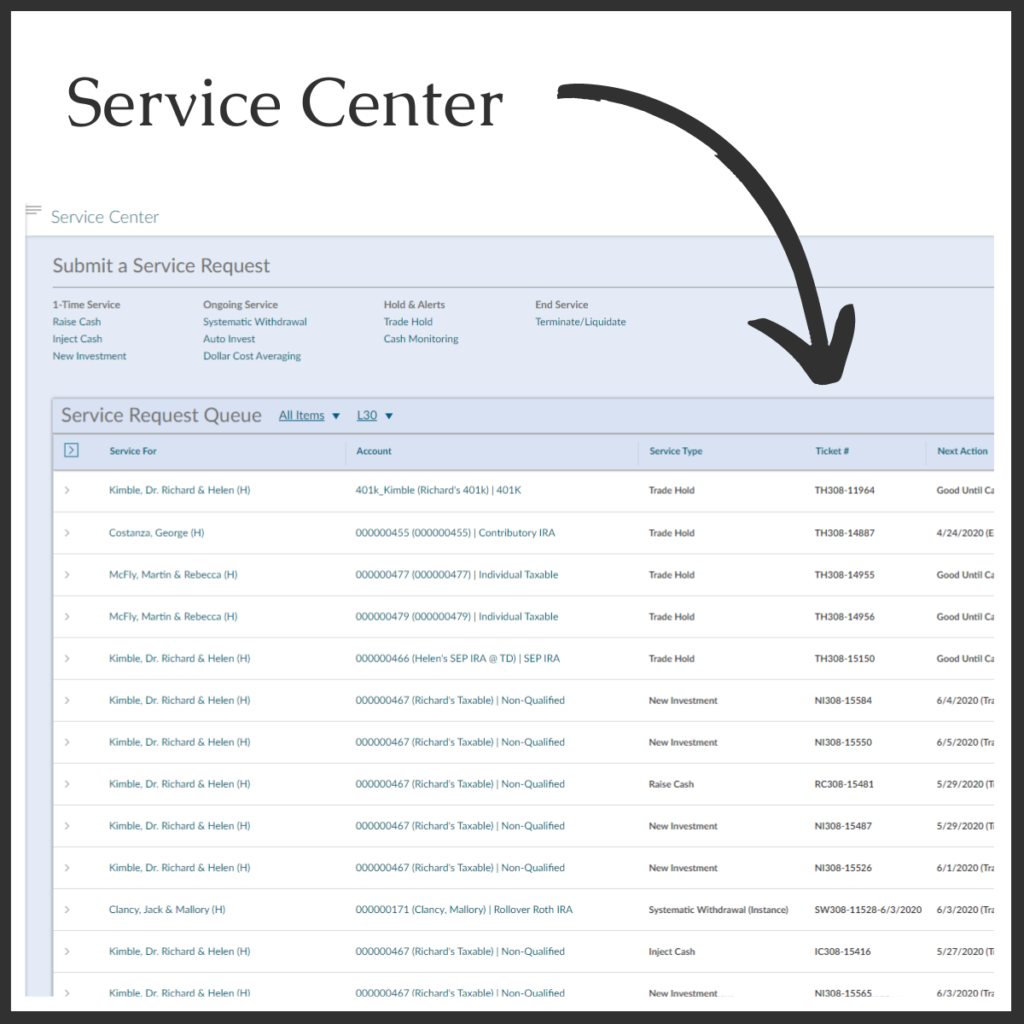

Check out their Service Center. It allows an advisor to input trading and investment requests directly in the portal – an important departure from the error-prone method of emailing Excel spreadsheets with manually entered position information. But it can also be used for new investments, raising cash, opening new accounts, dollar cost averaging, terminating positions, and more. All things that an advisor might do on their own or rely on another team member to do for them.

The Service Center maintains a live queue that offers real-time status updates and pertinent information – an operations person’s best friend. Isn’t that what running a successful practice is all about – ease of use and operational efficiency? I certainly believe so.

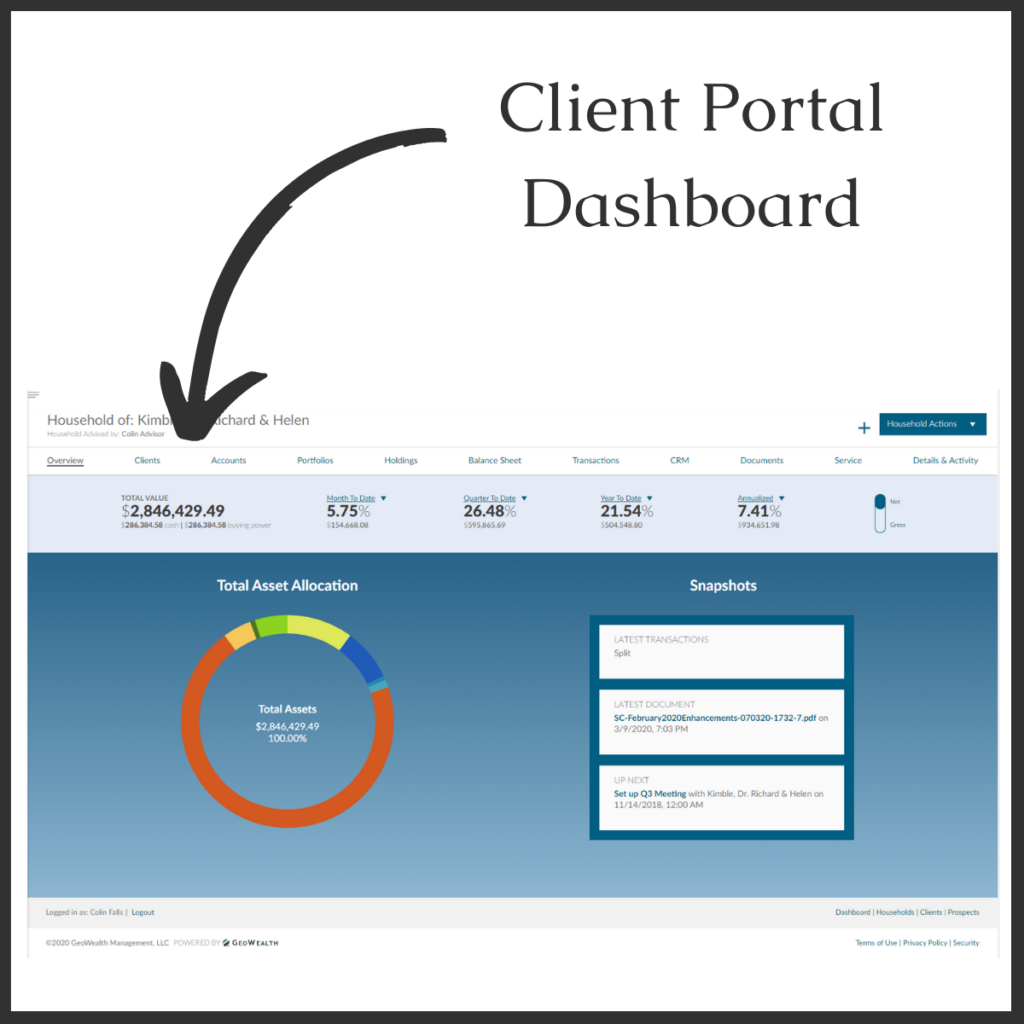

As a transition consultant who deals with thousands of data points and requests in high-stress, fast-paced situations, process-tracking and organization are at the top of my priority list. I also like things to be easy to understand and pretty to look at.

Which brings me to the next screenshot of the Client Portal Dashboard. So simple, sleek, and relevant.

When it comes to fintech, I admit I’m a little jaded.

Much of the work I do involves using the technology of the custodial platforms. I don’t often get to play with the shiny new toys. I’m stuck with the 1000 piece puzzles that are undoubtedly missing parts and take time, effort, and extreme concentration to navigate. All the fun new technologies usually start to get implemented when my job is done. I help advisors get up and running, establish new accounts, get transfers in process, have client conversations, and learn new custodial platforms. I’m working with the same outdated, underdeveloped, and frustrating technology ALL DAY LONG. Same pain points every time – no end in sight.

If only there were a TAMP for transitions. A TTMP (Turnkey Transition Management Platform) if you will. That is a piece of technology I would have no issue understanding and implementing, but I digress.

For now, I’ll have to settle for referring advisors to service providers who can help them research, understand, and implement the shiny new toys. If you’re an advisor who’s trying to run a successful practice using only the technology provided by your custodian, or you’re an advisor considering starting an RIA, explore your options. Or just call me. I’ll help you find the peeps you should talk to.

If a TAMP is what you’re looking for, let me leave you with a few GeoWealth takeaways:

- They offer true scalability. Their clients grow faster than the average RIA because they don’t have to hire staff in-house, which equates to less turnover risk and more cost-savings.

- They can seamlessly support a client’s growth in AUM and scale as they scale. Generally, firms need to hire additional traders or operations staff for every $100M they add in AUM.

- They’re one of the many platforms designed to help advisors run more efficient, successful businesses. They integrate with a lot of the other existing providers.

If you want to learn more about GeoWealth and its offerings or speak with an individual who can help you better understand TAMP offerings in general, reach out to TJ Gardner at tj.gardner@geowealth.com. As always, you can reach out to me as well at grier@advisortransitionservices.com and I’ll be happy to make an introduction.

I was not paid to write this article, but I do have a new arrangement set up with GeoWealth that requires me to insert the following language into this post: “This communication was written by a person other than a current client or investor. The author of this communication has not been compensated for this communication. Advisor Transition Services has a referral arrangement where they will receive $2,500 for every successful referral. Referral fees have the potential to create a conflict of interest and introduce personal bias.” So, reach out if you want an intro to GeoWealth to learn more about their platform. I would absolutely love to get paid to refer advisors to products and services that could help them achieve their goals.